JUMP TO: CAUSATION – London Joint Stock Bank v Macmillan | Lambert v Lewis | Forsikringsaktieselskapet Vesta v Butcher – REMOTENESS – Hadley v Baxendale | Jackson v Royal Bank of Scotland | The Heron II | Fletcher v Tayleur | Attorney-General of the Virgin Islands v Global Water Associates | Victoria Laundry v Newman Industries | The Achilleas | The Sylvia – MITIGATION – British Westinghouse v Underground Electric Railways | Payzu v Saunders | Pilkington v Wood | Wroth v Tyler | Banco de Portugal v Waterlow – TIMING – Johnson v Agnew | The Golden Victory – LIQUIDATED DAMAGES CLAUSES – Dunlop Pneumatic Tyre v New Garage and Motor | Cavendish Square Holding v Makdessi and ParkingEye v Beavis

RESTRICTIONS TO DAMAGES

Before damages will be awarded there are certain hurdles that must be cleared. These restrictions apply only to pecuniary losses.

CAUSATION

In order for damages to be awarded for loss it must be shown that the breach caused the loss, ‘but for’ the breach the loss would not have happened.

For example, certain events may break the chain of causation. In London Joint Stock Bank v Macmillan (1918) (HoL) it was argued that a third party was in fact responsible for the claimant’s losses and not the defendant’s breach. The defendant, who was a customer of a bank, argued that he had signed a blank cheque trusting a third-party agent to fill in the correct information. The agent turned out to be a fraudulent thief who ran away with the money. The claimant bank sued the defendant to reclaim the money paid out on the fraudulent cheque. The bank wished to debit the customer’s account for the sum paid out to the thief. Although the High Court of Australia and the Court of Appeal both agreed with the customer, the House of Lords overturned these findings in favour of the bank. It held that a customer had a duty to exercise reasonable care when signing a check to prevent forgery.

An act of a claimant may also be so unreasonable that it breaks the chain of causation between the defendant’s breach and the claimant’s loss. In Lambert v Lewis (1982) (CoA) a farmer continued to use a trailer coupling (i.e. the connection between the trailer and a main vehicle) after it was broken. The trailer was carrying a large amount of rubble when it broke away from the Landrover that was towing it and careered across the road into oncoming traffic. It collided with the claimant’s car and her son and husband were killed in the accident. The farmer was held liable in torts for the claimant’s tragic losses. However, the farmer tried to recover those losses from the manufacturer of the trailer coupling saying that it was a defective product. It was held that the farmer could not recover these losses because his continued use of the coupling, knowing that it was damaged, broke the chain of causation between the manufacturer’s breach of contract and the ‘loss’ suffered by the farmer in having to pay damages to the accident victims.

CONTRIBUTORY NEGLIGENCE

Where the claimant has contributed to the loss through their own negligence, but this negligence is not found to entirely break the chain of causation, their damages recoverable may be reduced under Section 1 of the Law Reform (Contributory Negligence) Act 1945. In Forsikringsaktieselskapet Vesta v Butcher (1986) (HoL) the court said that a ruling of contributory negligence could only be given where the defendant has concurrent liability in contract and tort law. In other words, the liability of the defendant must exist independently to the contract (in tort law) for the claimant to have contributed to it by their own negligence. Presently, contributory negligence does not apply to the breach of a strict contractual duty. Nor does it apply to the breach of a contractual duty to take care which does not correspond to a torts duty to take care. Therefore it only applies to the breach of a contractual duty that also constitutes a tort.

REMOTENESS

Before an innocent party is awarded damages it must be proven that the loss which has been suffered is not too remote a consequence of the breach (Hadley v Baxendale (1854) (Court of Exchequer)).

Hadley hired Baxendale to transport a broken mill shaft to Greenwich so that it could be used as a pattern for building a new shaft. The shaft was delivered late in breach of the contract. Due to the delay, Hadley’s mill could not function and he suffered a loss of profit. He sued Baxendale for this but the court found that the loss was too remote to be recoverable. It was reasonable for Baxendale to have assumed that the mill owned a spare shaft and he had not specifically been told that the mill could not function without it.

Two principles were established on the issue of remoteness of damage…

| 1. Only losses which arise ‘naturally, according to the usual course of things, from the breach of contract’ are recoverable; or |

2. Losses ‘that may reasonably be supposed to have been in the contemplation of both parties, at the time they made the contract, as the probable result of the breach of it’. |

The two principles are known as the ‘two limbs’ of the remoteness test and are not mutually exclusive (Jackson v Royal Bank of Scotland (2005) (HoL)) . The two limbs can be seen as relating to levels of knowledge held by the reasonable man.

FIRST LIMB

The first is the ‘usual’ consequences, what any person would have known would happen. Koufos v C Czarnikow Ltd (The Heron II) (1969) (CoA) held that in order to qualify as a loss which has occurred ‘naturally’ there must have been a ‘serious possibility’ or a ‘real danger’ or a ‘very substantial’ probability that the loss would occur. E.g. in Fletcher v Tayleur (1855) (Court of Common Pleas) the defendant who had agreed to supply or repair something which will obviously be required to generate profit for a business is liable for the ordinary loss of profits suffered as a result of its failure to supply or repair the item on time. In Hadley v Baxendale itself, Hadley could not satisfy this limb of the test as it was not obvious to Baxendale that the shaft was the only one available and therefore the loss was not a ‘usual’ consequence of the delay.

SECOND LIMB

The second is based on the specific knowledge of the parties. Although the test talks about the knowledge of both parties, it is generally the factual knowledge of the contract-breaker that is typically required (Attorney-General of the Virgin Islands v Global Water Associates Ltd (2020) (PC)).

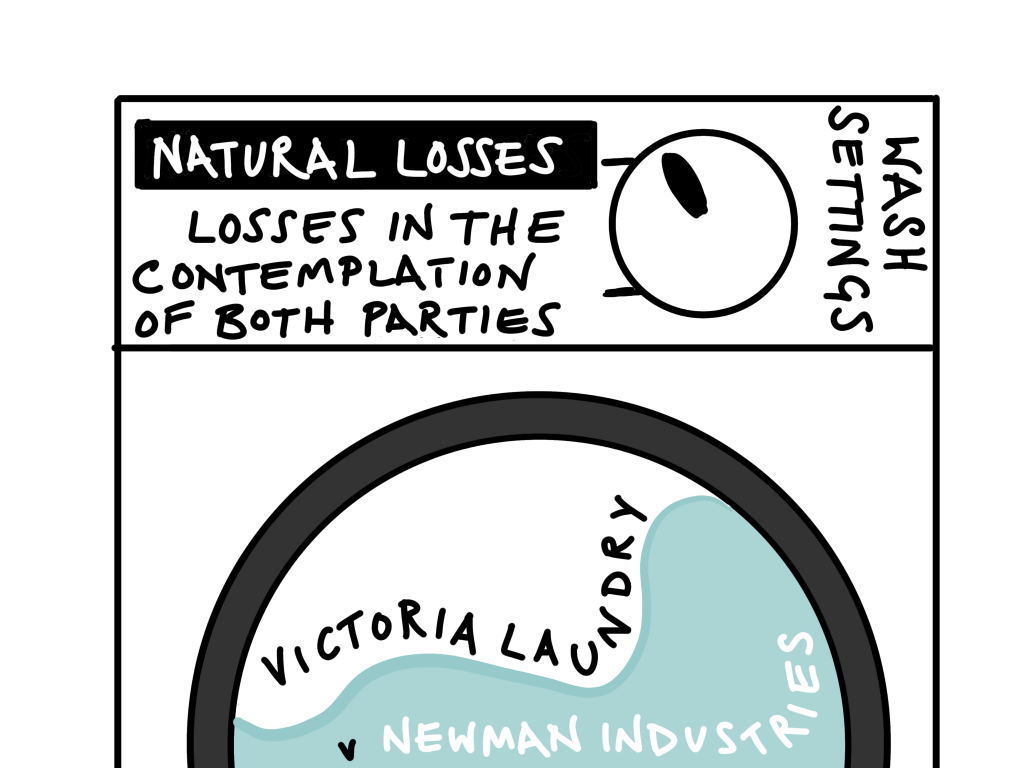

These principles were applied in the case of Victoria Laundry (Windsor) Ltd v Newman Industries Ltd (1949) (CoA).

Victoria Laundry purchased an industrial boiler for their laundry business from Newman and a delivery date was expressly stipulated in the contract. However, delivery was delayed by five months so Victoria Laundry claimed damages for both the loss of general profit during the period the boiler was delayed and the loss of a specific contract with the government.

The court held that the claimants could recover the loss of ordinary profits as it would have been reasonably foreseeable that the delay in delivery would lead to this loss, especially as the defendants were a specialist business who knew about the sector and knew that the boiler was needed for immediate use. However, the claimant could not recover the loss of the contract with the government as the defendant had no specific knowledge of this.

ASSUMPTION OF RESPONSIBILITY?

In Transfield Shipping v Mercator Shipping, The Achilleas (2008) (HoL) Lord Hoffman and Lord Hope formulated the remoteness test as one of an assumption of responsibility. In this case, charterers who redelivered a vessel late, were not held liable for all losses that the delay had caused to a subsequent charterparty (i.e. a contract to lease the vessel) as they had not assumed responsibility for that charterparty nor could they control it. As such, they were not liable for the actual losses caused by the delay, but only for market value of the 9 day’s delay. On this approach, the test for whether the loss is recoverable is whether it is of a ‘kind’ or a ‘type’ for which the contract-breaker ought fairly to be taken to have accepted responsibility. Although the House of Lords agreed on the losses recoverable, the Lords were divided in their interpretations of the test. Lord Rodger and Lady Hale found that the rule in Hadley was simply a question of what is foreseeable or ‘likely’. Lord Walker found Lord Hoffman’s assumption of responsibility test helpful, but did not actually endorse it.

In Sylvia Shipping Co Ltd v Progress Bulk Carriers Ltd (The Sylvia) (2010) (HC) Hamblen J confirmed that the orthodox Hadley v Baxendale approach ‘remains the general test of remoteness applicable in the great majority of cases’. The assumption of responsibility test, will only be invoked in a small minority of cases ‘where the application of the general test leads to an unquantifiable, unpredictable, uncontrollable or disproportionate liability or where there is clear evidence that such a liability would be contrary to market understanding and expectations’.

As such, it will not be necessary in the vast majority of cases to consider the assumption of responsibility test because ‘the fact that the type of loss arises in the ordinary course of things or out of special known circumstances will carry with it the necessary assumption of responsibility’.

DUTY TO MITIGATE

Where there’s a claim for financial loss the claimant is under a “duty to mitigate” the loss. However, the word “duty” is technically incorrect because the claimant will not incur any liability if such a duty is breached. The claimant will simply not be entitled to damages for any loss which they did not take reasonable steps to mitigate, or attempt to mitigate. In addition if the outcome of the mitigation is a recovery of all financial loss caused by the breach there can only be an award of nominal damages because there has been no loss (British Westinghouse Electric & Manufacturing Co Ltd v Underground Electric Railways Co of London Ltd (1912) (HoL)).

Underground Electric Railway purchased turbines from British Westinghouse which were deficient in energy consumption so they subsequently purchased new, more energy efficient turbines and claimed the cost of the replacement turbines from British Westinghouse. The court held that the cost of the replacement turbines was not recoverable because the new turbines were so much more energy efficient they had recovered most of the loss caused by the inefficient turbines. They could only claim for the loss of output before purchase of the new turbines.

REASONABLE STEPS?

What is reasonable will depend on the facts of the case. For example, if accepting the other party’s breach of contract presents the best means of mitigation then it would be unreasonable not to accept (Payzu v Saunders (1919) (CoA)).

Payzu contracted with Saunders for a delivery every month, for nine months, of crepe de chine at a discounted rate. Payzu’s cheque for the initial delivery was delayed and Saunders claimed, incorrectly, that this terminated the contract. Despite this, Saunders offered to continue delivery if Payzu paid in cash upon delivery. Payzu rejected this and bought the product elsewhere for more and then tried to claim the difference in price. The court held that reasonable mitigation would have been to accept the new offer, even though it was based on a breach of the original contract. Instead of doing so, Payzu went on to purchase the goods from the market at a higher price and chose to sustain a large measure of loss despite being offered a reasonable option by the seller, it failed to mitigate the loss and was not entitled to damages.

Whether a step was reasonable will be based on the circumstances at the time of the action rather than at the time of the court case with the benefit of hindsight.

Other examples include, embarking on expensive and complicated litigation was not reasonable in Pilkington v Wood (1953) (HC). It was reasonable that the claimant had not bought a substitute product in mitigation because he was financially unable to do so in Wroth v Tyler (1974) (HC).

INCURRING COSTS

Where the claimant does take reasonable steps to mitigate but this incurs expenses or increases the loss they will be entitled to reimbursement for this extra loss (Banco de Portugal v Waterlow (1932) (HoL)).

Waterlow held an exclusive agreement with the Bank of Portugal to produce Portuguese bank notes for distribution in the UK. Waterlow was tricked into printing 580,000 notes for a gang of international criminals. The fraudulent notes all bore the image of Vasco da Gama, a Portuguese explorer and nobleman. Upon becoming aware of the fraud the Bank made the decision to withdraw all of these notes and replace them with authorised notes. The problem was that many previously authorised notes in circulation also depicted Vasco da Gama so there was no way of knowing which ones were fraudulent and which ones were validly issued. As a result, the bank had to exchange a far greater number of notes than the 580,000 as its customers were panicked about the value of their money. The Bank made the decision to protect its commercial reputation by exchanging all the notes bearing Vasco da Gama. Waterlow argued that it was the Bank’s decision to replace good notes that resulted in its increased losses and that the Bank should have had ways of knowing which notes were good and which were fraudulent.

The HoL held that a person was not obliged to minimise his damages for a breach of contract if by so doing he would injure his commercial reputation, and in the circumstances the bank was justified in exchanging all the notes with the image of Vasco da Gama, both authorised and unauthorized.

TIME OF ASSESSMENT

The general rule is that damages are assessed by reference to the time of the breach which is generally when performance was due (Johnson v Agnew (1980) (CoA)). This means that if the breach of contract caused loss of £400 worth of goods at the time, but the cost of said goods is now £600, the defendant is only liable for the cost of the goods at the time, and not the extra £200.

However, in Golden Strait Corporation v Nippon Yusen Kubishika Kaisha (The Golden Victory) (2007) (HoL), the House of Lords ruled that the most important principle was that damages should reflect the loss suffered. If assessing damages at the time of breach does not achieve this position it should be disapplied even if this involves taking into consideration events that happened after the breach.

In The Golden Victory the defendant terminated a charterparty contract for hire of a ship and the claimant sued for damages. The charterparty had a clause that the contract could be terminated if war broke out. Following the defendant’s termination of the contract, the Gulf war did break out and this would have activated an automatic right to terminate the contract if it had not been terminated already. The defendants argued that damages should cover the time from termination to the outbreak of war (a number of months) rather than from termination to the intended end of the contract (a number of years). The court agreed and awarded damages that reflected the loss of a few month’s ship hire rather than a few years. The victim should be placed in the position as if the contract were performed but the court should not ignore facts that were available. The fact was that the Gulf war had broken out and this would have terminated the contract anyway.

PENALTIES & LIQUIDATED DAMAGES CLAUSES

Sometimes parties will include a liquidated damages clause into their agreement, this is a provision that sets a pre-estimate of damages recoverable from a particular breach. However, if the clause is in fact a penalty clause it will be unenforceable.

The classic distinction between a liquidated damages clause and a penalty clause was set out in Dunlop Pneumatic Tyre v New Garage and Motor (1915). A liquidated damages clause is a genuine pre-estimate of loss whereas a penalty clause ‘is extravagant and unconscionable in amount in comparison with the greatest loss that could conceivably be proved to have followed from the breach’.

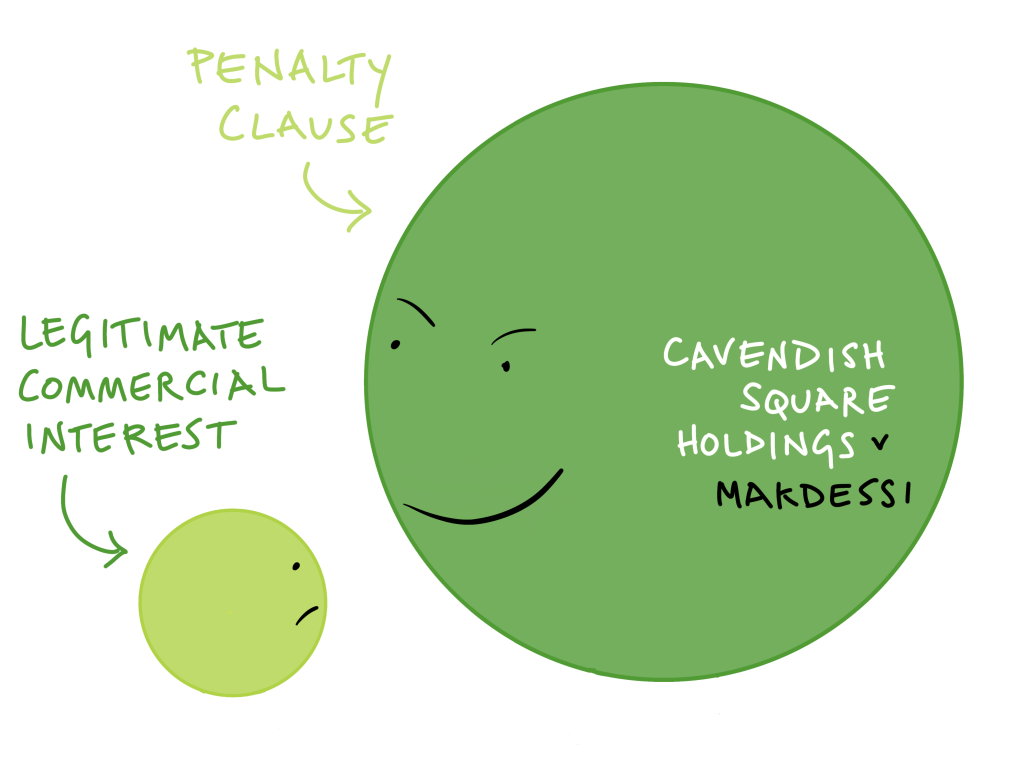

The law was considered more recently in the joint appeals of Cavendish Square Holding v Makdessi (2015) (SC) and ParkingEye v Beavis (2015) (SC). The Supreme Court held that the law that a penalty clause was unenforceable still stood but they updated the definition of what could be considered a penalty clause. The court also commented that the pre-estimate of loss test from Dunlop Pneumatic Tyre had achieved the status of a ‘quasi-statutory code’ which was unfortunate. Although it can be easily applied to simple scenarios, it cannot account for more complex matters.

‘The true test is whether the impugned provision is a secondary obligation which imposes a detriment on the contract breaker out of all proportion to any legitimate interest of the innocent party in the enforcement of the primary obligation’.

In other words, rather than asking whether the sum is a genuine pre-estimate of loss, the court must ask if the sum is penal and is out of proportion to any commercial interest, taking into account the commercial context and standing of the parties. This test gives wider scope for what can be considered a liquidated damages clause, especially in a commercial context.

MAKDESSI

Makdessi had sold a controlling interest in his marketing company to Cavendish Square. The payment of $147million was to be made in instalments. The contract contained a no-compete clause that prevented Makdessi from working for another marketing company. If the clause was breached no further instalments would be payable and Cavendish Square would gain the option to buy the remainder of Makdessi’s shares. Makdessi breached the clause but argued that it was a penalty rather than a liquidated damages clause and was therefore unenforceable.

The court held that the clause in Makdessi’s contract was not a penalty clause; although it imposed a harsh consequence for breach Cavendish had a genuine commercial interest beyond mere compensation in ensuring that Makdessi did not work for another company. The court also took into consideration the fact that both parties were of equal bargaining power with sophisticated knowledge of their industry and had taken the advice of top lawyers in the formation of the contract.

|

PARKINGEYE

Beavis parked his car in a carpark run by ParkingEye. The contract included a clause that anyone found staying beyond the 2 hour limit would be fined £85. Beavis was fined but challenged this; the clause was a penalty clause and also unenforceable under the Unfair Terms in Consumer Contracts Regulations 1999 as a term enforcing a disproportionate sum in compensation.

The clause breached by Beavis was also not a penalty clause. Although the payment of £85 was out-of-proportion to any financial loss that ParkingEye would suffer they had a genuine commercial interest in ensuring that parking spaces were free for other users and the only way that they could do this was to discourage people from staying longer by imposing a heavy fine. |

The difference between primary and secondary obligations was explained thus; “where a contract contains an obligation on one party to perform an act, and also provides that, if he does not perform it, he will pay the other party a specified sum of money, the obligation to pay the specified sum is a secondary obligation which is capable of being a penalty… if the contract does not impose… an obligation to perform the act, but simply provides that, if one party does not perform, he will pay the other party a specified sum, the obligation to pay the specified sum is a conditional primary obligation and cannot be a penalty.”